Use this option to maintain the Commission Code master file.

The Salesperson Commissioning system collects information from all sales and credits to customers. Salesperson commissions are calculated using a commission table and may relate to cost price, gross selling price or profit. Budgets can be maintained per salesperson for the full 12 months, and salesperson performance can be displayed or printed against these budgets. Current sales and past sales history are also maintained for each salesperson.

Commission can be calculated on gross profit ex-tax, gross profit including tax, total sales, or on cost of sales. The commission can be calculated on monthly sales with or without breakover points – for example, where the commissionable rate changes as a salesperson reaches a higher target of sales, that higher rate applying only to the upper level of sales (see the examples below).

Salesperson commission codes must be established before a salesperson is added. You should establish as many commission codes as you have different commission structures. Salespersons are then allocated the code of the commission structure relevant to them.

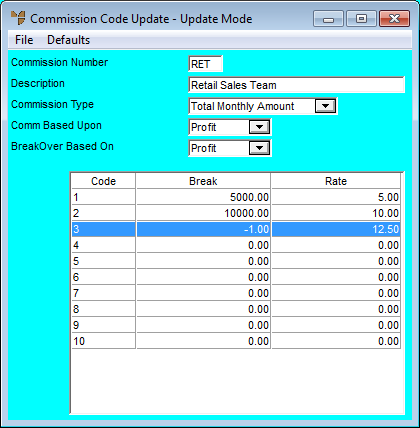

These calculations show an example of the Breakover method. In this example, the commission calculated for a total monthly sales margin (profit) of $12,000 would be calculated as:

|

$5,000 x 5% |

= $250 |

|

($10,000 - $5,000) x 10% |

= $500 |

|

($12,000 - $10,000) x 10% |

= $200 |

|

|

$950 |

On the Commission Code Update screen, this would be displayed as:

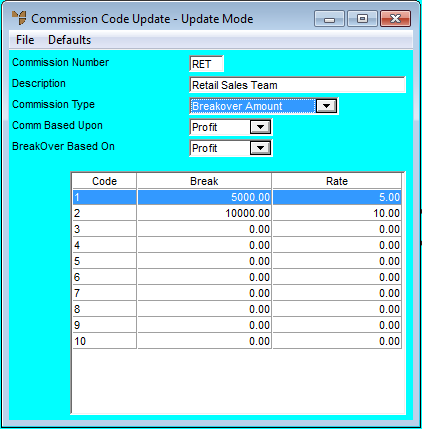

These calculations show an example of the Total Monthly Sales method. In this example, the commission calculated for a total monthly sales margin (profit) of $12,000 would be calculated as:

|

$12,000 x 10% |

= $1200 |

|

|

$1200 |

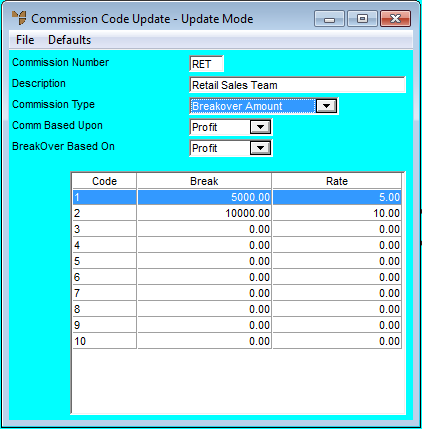

On the Commission Code Update screen, this would be displayed as: